Firms are taking control of the entire value chain to benefit from scale, reduced costs, agility and greater opportunities for innovation, but robust processes and compliance are crucial to success

With increasing regulatory pressure, aging technology and new competition across the financial advisory and investment management industries, profitability is becoming more difficult to maintain. To differentiate, firms seek to provide an end-to-end service to gain a greater share of “client wallet” by establishing a vertically integrated business. So, what are the pros and cons of vertical integration, and what does the regulator think about it?

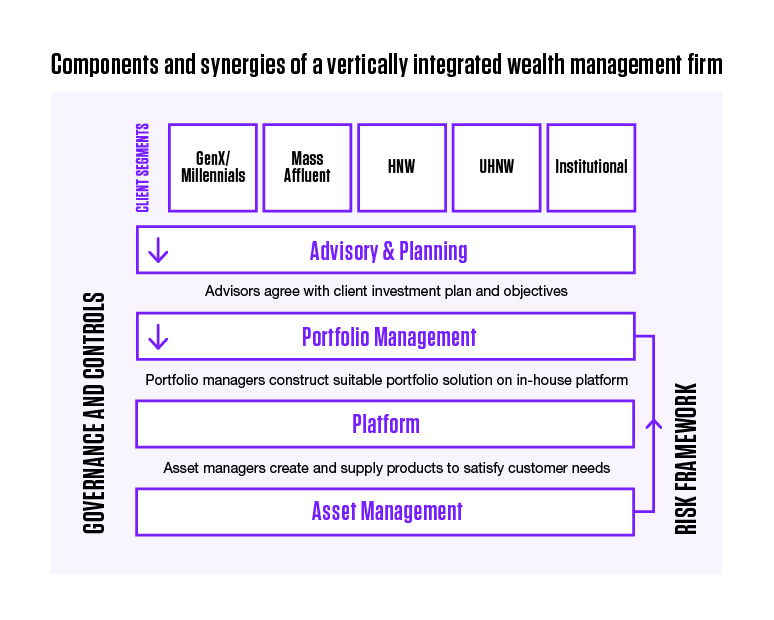

Traditionally, vertical integration involves a company expanding its operations throughout its supply chain, i.e. assuming control over the production and distribution steps involved in the creation of the end-product or service. Many industries have adopted vertical integration. Supermarkets, for example, act both as distributors of third-party products and manufacturers of their own products. Digital content companies, such as Netflix, have expanded operations beyond the online distribution of TV programs and films to include originally produced content [1]. A vertically integrated wealth manager is a business with capabilities from advice and planning through to platform, portfolio and asset management, i.e. the entire value chain.

Components and synergies of a vertically integrated wealth management firm

BENEFITS OF VERTICAL INTEGRATION

Vertical integration takes advantage of economies of scale, creating a business that is profitable in aggregate but tolerates low margins within individual business units. Well-managed vertically integrated firms react more readily and effectively to market challenges. They do so by investing and developing specialized products that meet customer needs and appeal to specifically targeted customer segments. Moreover, having a full view of their supply chain allows firms to syndicate knowledge between business units and encourage internal innovation.

If the advisory arm of a vertically integrated firm, for example, identifies an enhanced customer appetite for tax efficient investments, the asset management unit could be mobilized to design tailored product solutions that satisfy the emerging market need. An additional benefit is the promotion of common accountability across the value chain towards customer needs, leading to increased employee engagement.

Key performance indicators and customer feedback can be used to support this shift to a customer-centric culture and increase accountability beyond business unit level, as has been successfully demonstrated by financial services providers. For example, ING introduced business performance scorecards and enhanced accountability for customer satisfaction across the firm both at business unit (IT organization) and individual level [2].

Steve Murray, the CEO of U.K.-wide financial planning business 1825 (part of Standard Life), said: “The benefits of vertical integration include stronger collaboration between different parts of a group of companies to develop solutions that support client needs. It can also benefit from enhanced scale which can enable cost savings to be passed on to the client. This may be more difficult for small enterprises to achieve. Vertical integration should also reinforce sustainability so clients can be more assured of consistent advisory relationships that won’t be impacted with the difficulties often created by succession planning in the longer term.”

RISKS

Wealth managers also need to be aware of the inherent challenges that a vertically integrated approach could bring. Firstly, integration typically requires a large amount of capital [3] and business investment (particularly in time and expertise) to implement. Executed poorly, functions within the firm may regress into operational silos, stifling flexibility and restricting the ability to react to evolving customer needs. Furthermore, conflicts of interest could arise with vertically integrated wealth managers providing advice to their customers while acting as financial product manufacturers, providers and distributors of internally produced and third-party products.

It is crucial for vertically integrated firms to have a robust internal controls framework and reliable compliance and audit functions that manage and mitigate risks. Strict corporate governance is also significant to satisfy any conflict of interest challenges from the regulator [4].

Steve Murray added: “It’s important that the different component parts of any model are regularly tested for suitability, performance and competitiveness. A model that then doesn’t allow componentry to be substituted if it isn’t performing may not be able to deliver against client needs. Furthermore, models which shoe-horn clients into solutions have the potential to create poor customer outcomes.”

REGULATORY PERSPECTIVE

The rules introduced under Retail Distribution Review (RDR) in 2013 aimed to stop vertically integrated firms from subsidizing the cost of their advice business with profits generated through product selling. However, the FCA guidance set out that some cross-subsidization is permitted if it is “insignificant in the long term.”

Based on industry feedback, the FCA is proposing amendments to these rules. The regulator’s December 2016 Quarterly Consultation [5] contained a proposal to change the existing guidance and clarify that cross-subsidization for most businesses will be permitted with a five-year limit, but, depending on the nature of the business, longer timelines could be acceptable.

Steve Murray added: “The regulator, rightly, has a strong focus on ensuring positive client outcomes and that the market works well for individuals looking to use its services. In this respect, the need for a vertically integrated distribution firm to be able to function in its own right imposes a healthy discipline which encourages firms to seek efficiencies and create competitive propositions.”

A GROWING TREND

Exemplars like St. James’s Place, Old Mutual Wealth and Standard Life [6,7,8,9] are indicative of the potential and growing trend of the vertically integrated business model. The benefits are vast: profitability via economies of scale, competitive advantage, knowledge syndication and innovation, and the customer-centric focus through increased and internal and external engagement.

However, tough lessons have been learned from the efforts of product providers that attempted to expand their operations and create their own advisory arms through acquisitions. For example, Friends Life suffered a £19m operating loss from the purchase of the advisory network Sesame Bankhall Group. Aegon recorded a €22m loss from the acquisition and subsequent sale of Positive Solutions, a distribution network [10,11].

The wealth management industry has many examples of acquisitions that have failed to live up to expectations. Due diligence and implementation planning are vital in these transactions, while successful transformation needs a clear strategy, governance, skills and commitment.

Steve Murray concluded: “A variety of offerings and business models – ensuring that any component is leading in its own right – is a real positive, provided they deliver consistently good outcomes for clients.”

Contributors: Philippa Halliday, principal consultant, and Joshua Ablett, associate consultant

References

•[1]. http://www.portfolio-adviser.com/features/1028786/business-insights-ld-mutual-wealth

•[2]. https://surveymethods.com/kb/customer-satisfaction-scores/

•[3]. http://www.mckinsey.com/business-functions/strategy-and-corporate-finance/our-insights/when-and-when-not-to-vertically-integrate

•[4]. https://www.moneymarketing.co.uk/analysts-warn-vertical-integration-will-face-regulatory-pressure/

•[5]. https://www.fca.org.uk/publication/consultation/cp16-39.pdf

•[6]. https://www.moneymarketing.co.uk/41-heather-hopkins-piecing-together-the-vertical-integration-puzzle-pic-with-art/

•[7]. https://www.moneymarketing.co.uk/issues/2-june-2016/creating-a-monster-the-race-to-become-the-new-sjp/

•[8]. https://www.moneymarketing.co.uk/platforum-competition-hotting-wealth-management/

•[9]. https://www.moneymarketing.co.uk/issues/7-april-2016/platform-focus-old-mutual-wealth-is-at-a-critical-juncture/

•[10]. http://citywire.co.uk/new-model-adviser/news/nolayout/adviser-acquisitions-the-good-the-bad-and-the-downright-disastrous/a797957

•[11]. https://www.aegon.com/siteassets/investors/financial-reporting/2013/aegon-annual-report-2013.pdf/