Our 2023 Global Insurance Survey captures responses from 13,750 consumers across 14 individual markets and 15 demographic groups, with a view to:

These survey findings inform insights and recommendations from Capco’s local insurance experts on the key roles of data and personalization as insurers map their optimal path forward in an increasingly digitalized and competitive marketplace.

Read on to access our global report and individual market commentaries.

The challenges that insurers face today will be familiar to institutions across the financial services industry. Customer engagement and retention in a digitalized, post-COVID world that has reshaped expectations and needs. Ongoing cost pressures that are now only exacerbated by inflation and the current market downcycle. The imperative to modernize legacy systems and architectures while maintaining operational stability and a high quality of service across multiple channels day-to-day. The commercial threat both from existing competitors and external disruptors, be those new players or game-changing technologies such as today’s increasingly powerful AI models.

As insurers survey this dynamic and uncertain future landscape, data is one of the levers available to enact change and ensure their relevance to their customers. High quality data is the engine of transformation: giving form to opportunities, both current and emerging; illuminating behaviors and attitudes; and validating strategic and investment choices.

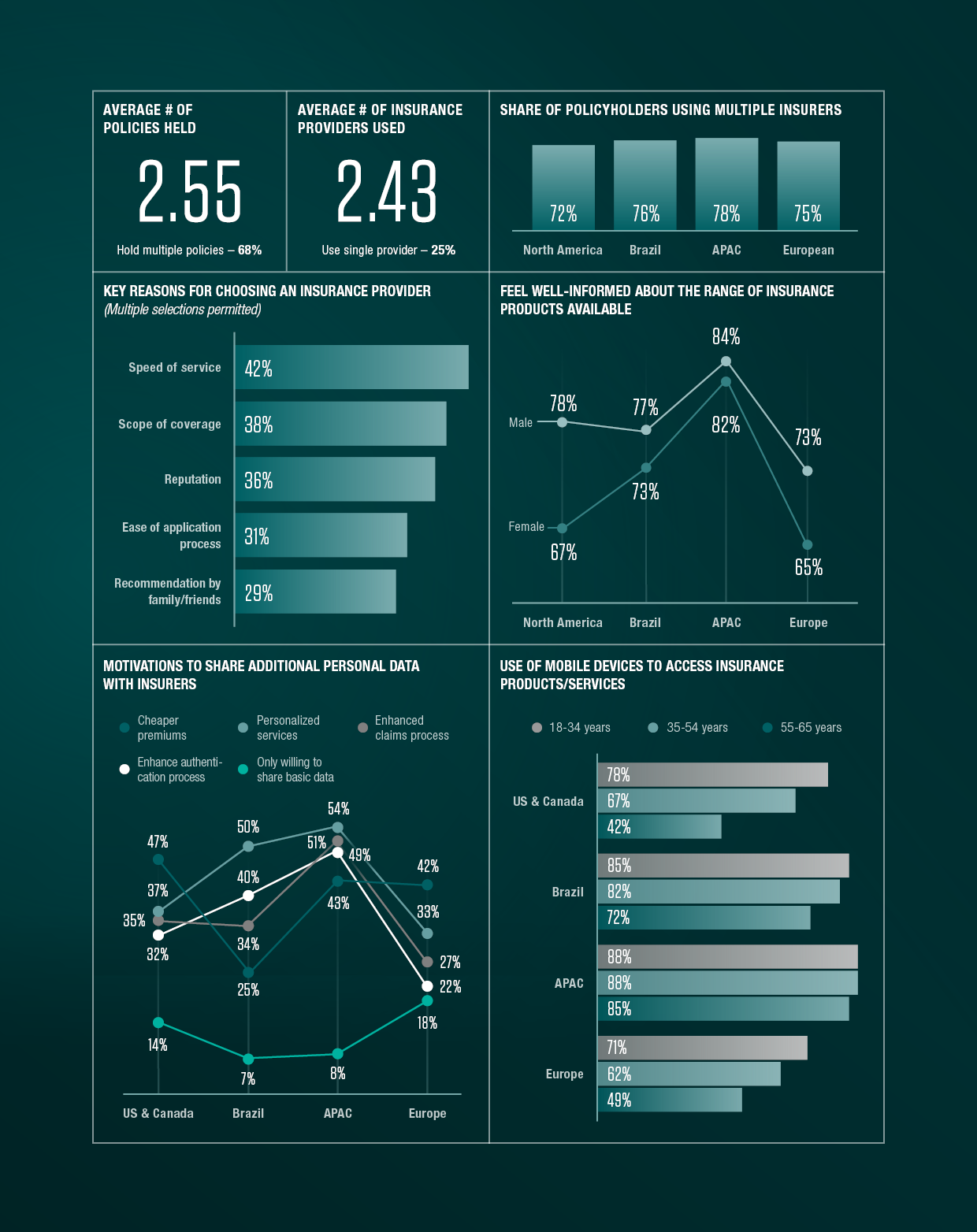

For the insurance customers surveyed in our latest research, data is something they are overwhelmingly prepared to share to gain benefits: cheaper cover, more tailored policies and services, smoother processes and interaction. Data, and the hyper-personalization of products and omnichannel experiences it facilitates, are key to enhanced customer satisfaction and loyalty.

The central challenge facing insurers is how to extract maximum value from their data to support appropriate nudges and tailor products. Many are already working on building modern data platforms based in the cloud and built on the curation of high-quality data products. Development of these products, and the uplift in operating models to use them effectively, will be key to enhancing digital experiences as part of personalized customer journeys and outreach, and to improving fraud monitoring and management of the claims supply chains. These are all important priorities as insurers look to seize tomorrow’s opportunities across the key vectors of customer satisfaction, commercial growth and competitive differentiation.

Interviews for our 2023 global insurance survey were conducted across Belgium, Brazil, Canada, Greater Bay Area (ex Hong Kong), Germany, Hong Kong, Italy, Malaysia, Poland, Singapore, Switzerland, Thailand, USA and the UK during February and March 2023. Respondents were insurance policyholders aged between 18 and 65 years. This was a quantitative study conducted using diverse sampling methodology (social & ad networks). Country representative quotas (location, age and gender) were applied.