SWITZERLAND’S FIDLEG/LSFIN : HOW TO ENSURE SMOOTH IMPLEMENTATION AND MAXIMIZE THE VALUE OF INVESTMENT IN MIFID II COMPLIANCE

- Published: 03 July 2019

On 15 June 2018, the Federal Council (Switzerland) and the Council of States adopted FIDLEG/LSFin and FINIG/LEFin. The acts are expected to come into force on 1 January 2020 and introduce an entirely new framework of rules for Swiss financial intermediaries.

The impact on the Swiss banking market players varies dramatically depending on whether they have already implemented MiFID II or not. In either case, it is of utmost importance to work on the new acts now to ensure smooth implementation.

KEY CONSIDERATIONS FOR MIFID II COMPLIANT BANKS

In general, the Swiss banking world can be split into two major categories: those that have been implementing MiFID II over the past few years and those that have not. Both categories will be impacted by FIDLEG/LSFin, but from very different angle.

Many market participants believe FIDLEG/LSFin compliance is covered by the recent MiFID II implementation, as it can be concluded that MiFID II applies stricter rules than FIDLEG/LSFin. This assumption does not hold true, and even banks that have already implemented MiFID II will need time to make key decisions and work out certain details (we will consider these later in this blog). As an example, all financial players will need to consult whether to treat all clients similar or to implement different regimes depending on the country of residence.

In summary, the impact on MiFID II compliant banks is lower, but it does not mean that those banks can afford to waste time. FIDLEG/LSFin can help those banks to improve. Banks that have not implemented MiFID II are facing a full-scale compliance project that will impact every cornerstone of the revenue cycle. Below are the three key points to consider.

1. CLIENT SEGMENTATION AND ITS IMPACT ON BANKING SERVICES

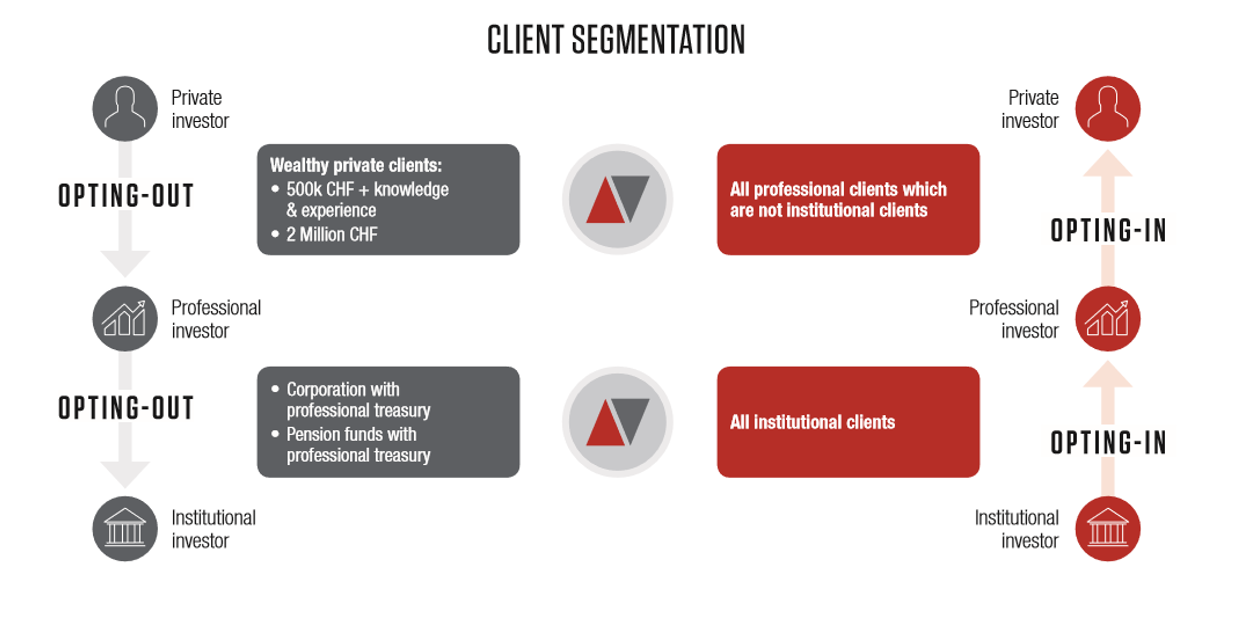

FIDLEG/LSFin requires banks to segment their clients into private, professional and institutional categories. The segmentation must be communicated to the client once pe

rformed. The regulator defines the segmentation with a set of parameters, however FIDLEG/LSFin allows opting-in and -out.

- A retail client with enough investment experience and funds (min of 500K CHF) can declare themselves a professional client (i.e. optout), waiving protection rights for a wider product scope.

- A professional client can ask to be treated as a private client (i.e. opt-in) in order to receive higher protection rights traded against a narrower product scope.

Clients can only opt-in or -out one level, providing all requirements are fulfilled, and banks are required to document these changes in detail.

MiFID II introduces similar segmentation categories, however, parameters vary in some instances. For example, pension funds without a professional treasury receive a higher protection under FIDLEG/LSFin. In addition, the opting rules are similar but not identical, so each financial institution must decide whether to find a unified solution or implement two regimes. Where no EU-domiciled clients are served, all clients must be segmented with a focus on joined accounts and accounts with multiple beneficiaries with different competencies.

2. APPROPRIATENESS AND SUITABILITY CHECKS

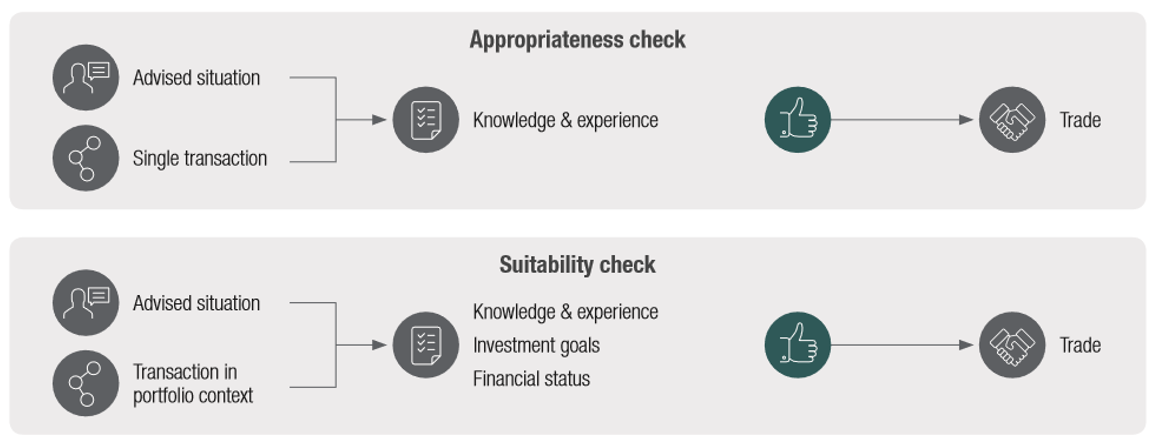

FIDLEG/LSFin introduces the obligation to perform appropriateness and suitability checks before selling products to clients. While appropriateness applies on a trade-by-trade basis, suitability needs to be checked in the wider portfolio context.

The appropriateness check tests the end-client’s knowledge and experience of a given product. If the client does not have any or enough knowledge and experience, he or she can be educated by the client advisor.

The suitability check assesses the financial capabilities, investment goals and takes into account the knowledge and experience of the client in the wider portfolio context. For example, a put option might not be appropriate by itself but is acceptable within the portfolio context as a hedge against losses.

Under MiFID II, similar checks must be conducted, however more aspects must be considered to assess suitability. To guarantee compliance, such processes cannot be performed manually and changes within the core banking system require careful and time intensive preparation. In addition, all clients must be contacted and assessed to enable those checks. Financial institutions that already perform these checks must decide whether to leverage the existing regime or to perform the checks under two regimes.

3. INDUCEMENTS AND THE OVERALL PRICING STRUCTURE

Even though FIDLEG/LSFin requirements appear less severe, inducements remain a sensitive topic within the banking community. FIDLEG/LSFin does not call for non-independent advice, nor does it ask for quality enhancement justifications to keep inducements. Clients must be made aware and must express their consent in writing to allow the bank to retain inducements.

However, in a globally connected business world it would be hard to retain a purely Swiss approach as clients will notice different fees being applied in other jurisdictions. In addition, clients are increasingly unwilling to pay for services they do not need. Whether enforced by regulation or not, it is evident that fees can only be retained if justified by real added value. A solution could be to automate ‘mass’ business while charging for tailored premium services.

CONCLUSION

ZURICH

Dr. Ingo Rauser Partner

E: ingo.rauser@capco.com

M: +41 79 203 58 85

Marc Oliver Berner Manager

E: marc.oliver.berner@capco.com

M: +41 79 135 85 21

Schoaib Fazeli Principal Consultant

E: schoaib.fazeli@capco.com

M: +41 79 833 72 02

GENEVA

Pierre Rouzaud Partner

E: pierre.rouzaud@capco.com

M: +41 79 266 44 11