Is wealth management the last industry that does not yet have a single holistic view of each client? Many larger private banks and wealth managers in Switzerland still do not have full knowledge of their clients’ combined risk exposure across business lines and booking centers.

Although the bankruptcy of too-big-to-fail banks is a tail risk, such considerable events are amply documented, analyzed and discussed. Yet, lessons of such failures do not appear to have sunk in.

The lack of a single, comprehensive client overview, together with a risk culture focused exclusively on revenue, growth and time-to-market rather than being balanced by risk mitigation, reliability and reputation, is what causes banks to exceed their risk appetites.

In this article, we discuss how Swiss private banks and wealth managers can address the balance between risk and return.

HOW DID WE GET THERE?

The lack of a holistic client overview within Swiss private banking is not a big surprise. Banks in Switzerland initially focused exclusively on wealth management. To improve their business mix and reduce volatility of revenues, they began to diversify into other financial services, such as investment banking, asset management and structured lending. Business divisions were often intentionally managed in a decentralized way, to better focus on client needs and client proximity, and ultimately generate better results.

The resulting transformation missed one basic element - that the left hand should always know what the right hand is doing. In other words, the senior management of the bank should at all times have knowledge of the combined, holistic exposure of each client across business lines and booking centers. And while cross-selling between business divisions has been encouraged, cross-monitoring of the resulting risks has been largely neglected.

One might say that regulators have learnt from the financial crisis of 2008 and imposed stricter capital adequacy rules to prevent too-big-to-fail from failing, thereby reducing systemic risk. However, in an industry where reputation is everything and in a digital wealth management world where a social media post can challenge a bank’s reputation and a client can withdraw their significant deposits with a click, a ‘bank run’ can happen within a few hours. The too-big-to-fail capital adequacy rules provide ample capital cushioning to absorb financial losses but do not cater sufficiently for liquidity risks.

WHAT RISK CULTURE?

Even with the right level of risk appetite, a bank could still get into trouble through inadequate risk culture, where the first line of defense (front office) focuses heavily on bringing in clients, assets and revenues, and removes itself from due diligence and risk monitoring, assuming it to be the responsibility of the second line of defense (operations and compliance).

This narrow focus on clients and performance has one serious consequence - a new negligence in the balance required between revenues and risks. Revenues do not even need to be significant; the promise of a substantial future revenue is often enough to overshadow risk considerations.

Client-facing employees typically enjoy greater prestige and power than other lines of defense within a bank, and, incentivized by bonuses linked to assets and revenues, do not find it difficult to ignore or exceed the risk appetite limits imposed by the institution.

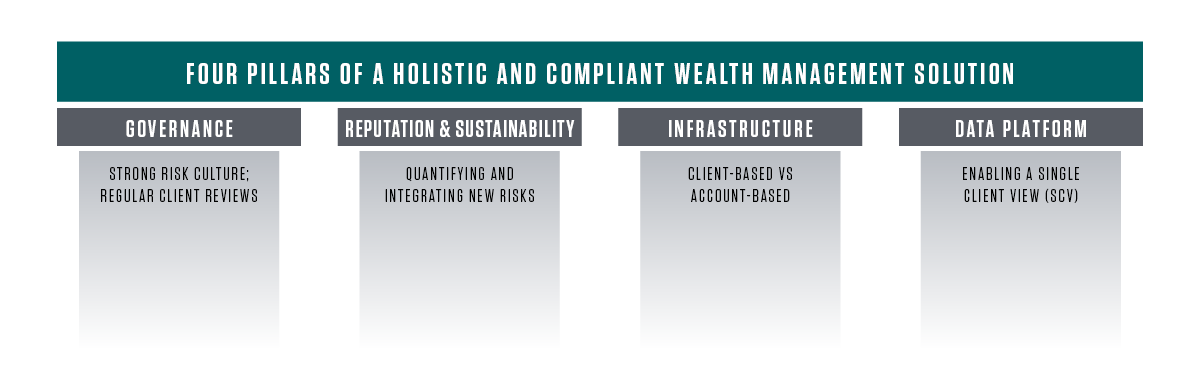

A MODERN COMPLIANCE SOLUTION: FOUR PILLARS OF HOLISTIC WEALTH MANAGEMENT

Senior management plays a key part in fostering a healthy risk culture and establishing effective oversight, across four pillars, as described below.

1. Governance: A strong risk culture is a must

From client onboarding, KYC and due diligence and throughout the entire client relationship lifecycle, the first and second lines of defense need to work in tandem and have mutual respect.

Clients pose reputational and credit risk for banks. These risks need to be regularly reviewed and weighed against current and future revenues (including at senior management level for the riskiest clients). Very often, only the revenues side is taken into consideration.

Quite simply, client governance must cover both – risk appetite and returns, and the bank’s risk culture needs to foster an environment where the agreed limits are understood and adhered to.

2. Reputation and sustainability: Measuring and integrating additional risks

While credit and market risk have defined market practices in terms of quantification and risk appetite setting, the quantification of reputational and sustainability risks is still an early and controversial topic, and many banks are not equipped to assess or integrate them into their risk management frameworks.

However, private banks and wealth managers must not underestimate the importance of reputation for their success and survival.

Although qualitative and complex in nature, both reputational and sustainability or environmental, social, governance (ESG) risks can be effectively monitored and measured across banking processes. Recent regulatory initiatives across the globe, such as FINMA’s circular on climate risk, are putting pressure on banks to integrate these risks into their enterprise risk inventories as standard.1

3. Infrastructure: Client-based vs account-based

Swiss banking secrecy, although a thing of the past, has ensured that wealth managers are kept in the dark about their clients’ full range of activities.

Clients are assigned an account number within each division of the bank they interact with (private banking, asset management, investment banking, etc) and for each booking center they bank with; clients are then identified by these account numbers. This means that cross-divisional clients appear in multiple systems, databases and management reports, and, typically, there is no consolidation and no single client view (SCV) available.

While smaller private banks that focus on one or two business lines find it easier to facilitate SCV, these initiatives are non-existent or in their infancy at large and medium-size institutions.

4. Data platform: An enabler of SCV

Some banks have started aggregating holistic client information from multiple sources and database technologies, however, it is still very much a manual and work-intensive task. And once the relevant data is collected, there is no consolidated platform available to support this wealth of information, as most banking apps specialize in either business data (product, revenue, AUM) or segregated risk data (credit exposure, market risk exposure, etc).

A client-centric model relies on a robust data management platform, which will match clients across divisions and booking centers, pull data from multiple databases and present it in a meaningful and holistic way to provide clear reporting and actionable insights for wealth managers. Such a model can obviously only prevail with clients’ legal consent, which can be secured in a variety of ways.

CONCLUSION

Swiss private banks and wealth managers are not far off closing the gaps in their risk management. With senior leadership setting the tone from the top, addressing just some of the best practices described above will generate quick-win solutions and lay the foundation for a modernized, holistic approach.

HOW CAPCO CAN HELP

Capco’s recent experience in integrating reputational and sustainability risks into the overall risk management, combined with our vast expertise in data and analytics, single client view (SCV) solutions and governance framework implementations, make us your ideal partner for addressing the challenges described in this article.

We have developed an accelerated approach to review governance, processes, infrastructure and data to identify quick wins aimed at delivering the right balance between risk and return.

Contact us to discuss how we help you cut through the complexities of legacy core systems and data layers, to develop a bespoke data platform offering a holistic client overview, enhance your risk culture and establish comprehensive governance and compliance frameworks.

REFERENCES

1 Swiss Financial Markets Supervisory Authority (FINMA) -20230124-finma-aufsichtsmitteilung-01-2023.pdf