Following multiple industry consultations and the interruption of a global pandemic, ongoing efforts to render the global financial system safer, more resilient, and more sensitive to idiosyncratic and systemic risks have reached a key milestone.

On July 27, 2023, the Federal Reserve, Federal Deposit Insurance Corporation (FDIC) and Office of the Comptroller of the Currency (OCC) entered the last mile of a decade-long journey with the release of proposed final requirements for the US Basel III implementation – commonly known as the ‘Basel III Endgame’ or the ‘Endgame’.1

Given that US regulators have proactively and regularly communicated their expectations since the global standard was originally finalized in 2011, few market participants were likely surprised by the broad themes within this latest announcement. However, both the volume of requirements and the presence of some key strategic shifts – for instance, the expansion of requirements for banks with between $100bn and $250bn in assets following 2023’s string of US bank failures – mean it is worth taking a closer look at the details.

For banks, US Basel III impacts both business strategy and regulatory compliance – and these two often intersect. Specifically, the Endgame comes after a series of record rate hikes by the Fed, with Fed Funds at a 22-year high; impacted banks now face parallel concerns about higher capital requirements and funding costs. Since both banking and trading lines of business (LOBs) are impacted by these parallel concerns, in-scope banks should also consider the broader implications of Basel III across LOBs as well as specific risk segments pertaining to individual LOBs.

US Final Rule Clarifies Regulatory Priorities

Described as “the biggest revamp of capital rules for US banks since the aftermath of the financial crisis”2, these policy measures change the game for a broad swathe of the US banking sector.

Impacted banks have a 120-day window in which to respond, and below we categorize the changes based on a handful of the regulators’ strategic priorities:

Implications Across Risk Segments

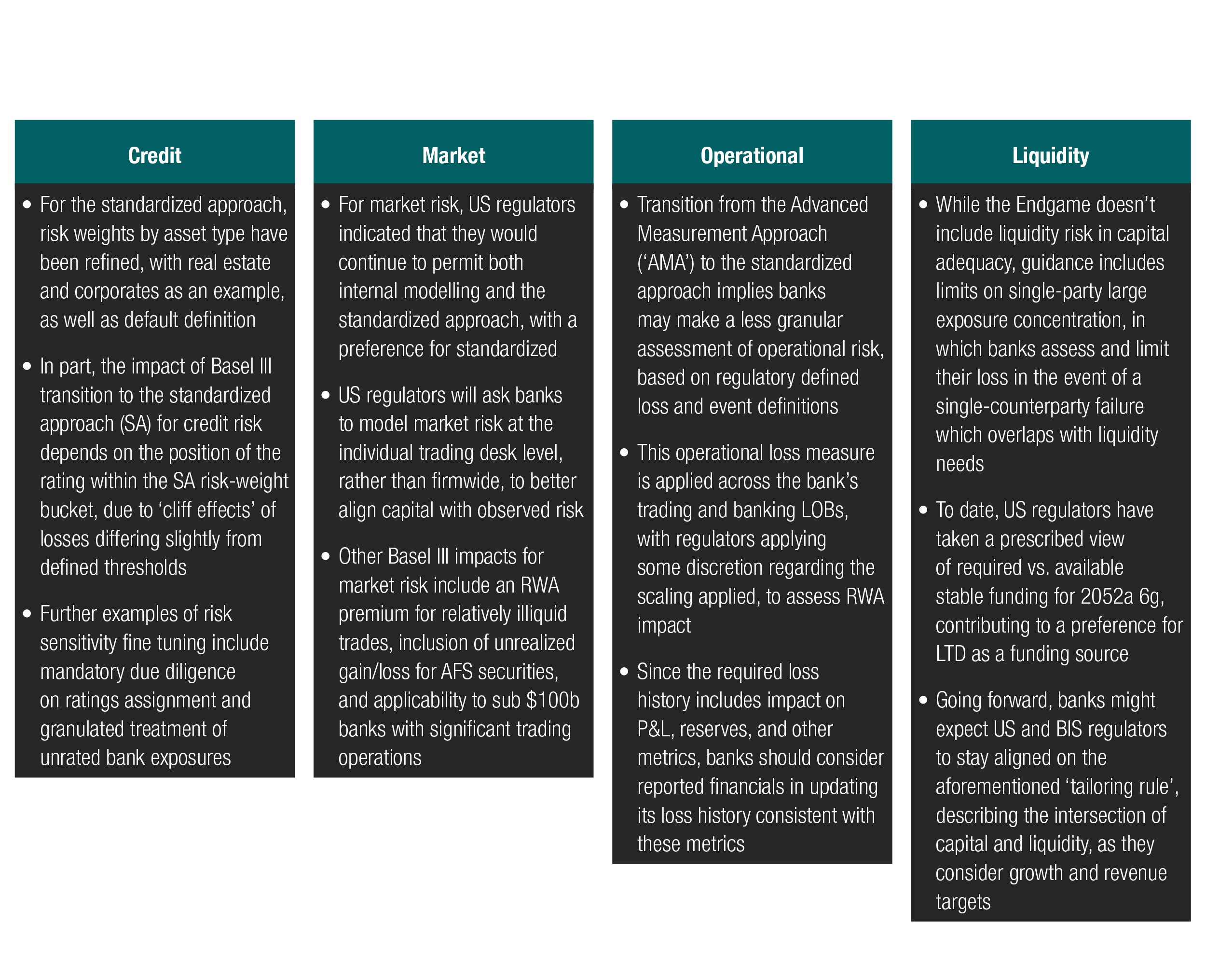

For many banks, the Endgame has an asymmetric impact across trading and lending LOBs, with more punitive capital charges across risk segments applying to those LOBs and activities viewed to affect the safety and soundness of the financial system.3 For this reason, it is worth looking at specific implications of the Endgame on individual risk segments.

The Bottom Line For Impacted Banks

At the Fed’s July 27 board meeting, governors made it clear that they hope for a robust, constructive commentary period, and invited input on specific items such as the stability/liquidity trade-off of higher capital, impacts on specific LOBs (e.g. mortgage lending), and feasibility of requirements for $100bn-$250bn banks. That being said, the Endgame makes certain strategic priorities clear and gives banks the direction and runway to revise product strategy for the new capital regime and plan for compliance with the newly communicated implementation window.

High-level takeaways include:

- US Final Rule on Basel III capital requirements shifts the priority for capital assessment from advanced to standardized approaches

- As $100b institutions are now subject to this final rule, a broader universe of banks must update their capital planning and reporting capabilities

- Capital requirements across all LOBs will increase, implying an impact on product strategy and profitability

- Since both banking and trading sides of the house are impacted, banks should address these new challenges proactively across the entire enterprise

- The proposed ‘fully phased in’ date for the Endgame is July 1, 2028

We welcome your feedback and would be pleased to discuss your challenges around optimizing your capital strategy.

References

1 Basel III: A global regulatory framework for more resilient banks and banking systems - revised version June 2011

2 Banks’ $118 Billion Buffer Likely Wiped Out by New Capital Rules

3 US Banks Face Capital Jump With More Lenders Roped In to Comply