In 2015, the EU adopted the Securities Financing Transactions Regulation (SFTR) to increase transparency of securities financing transactions (SFTs) in the European market. SFTR is the EU’s response to the G20 concerns about high- risk activities moving from regulated banking entities into unregulated ‘shadow banking’. This regulation established that both parties to an SFT need to report new, modified or terminated SFTs to a registered or recognized Trade Repository (TR), including the composition of the collateral. STFR’s reporting go-live timeline is scheduled between 2020 and 2021, with the first phase now fast approaching.

Due to its similarities with the European Market Infrastructure Regulation (EMIR), which focuses on increasing transparency in the European derivatives markets, most financial institutions have tended to overlook the specifics of SFTR and are yet to address the potential challenges it poses to their business.

SFTR includes a set of new rules on collateral reuse, transparency for fund investors and new reporting obligations.

The first reporting obligation is expected to start in April 2020. The following rules will apply:

If your institution falls into one of the below categories and deals with the activities listed, you are impacted by the SFTR’s reporting obligation.

SFTR’s reporting timeline is scheduled over four phases, according to the type of firm (as shown below).

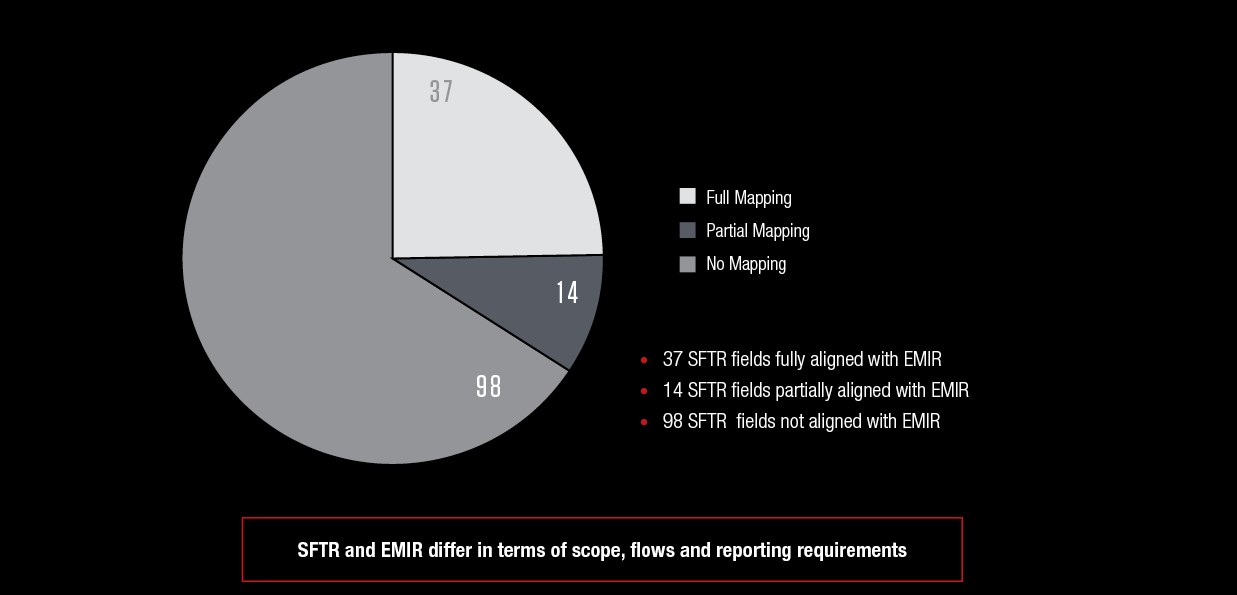

Although the two regulations both aim to increase transparency around collateral transfers, the reporting differs significantly in terms of scope, flows and other requirements between EMIR and SFTR.

Whilst businesses understandably focus on SFTR compliance, they must not overlook the regulation’s impact on their trading activity and operating model. At Capco, we have assessed the impact on the Target Operating Model and see significant impacts on end-to-end processes, controls and technology.

Through the combination of a strong regulatory background and deep industry expertise, Capco’s experts provide comprehensive regulatory consulting and strategy services to support businesses of any size. In addition, we leverage the experience of our global regulatory and SFTR practitioners to learn from markets (e.g. the UK) where SFTR has already been implemented.