SEE HOW CAPCO HAVE HELPED A NUMBER OF FINANCIAL SERVICES INSTITUTIONS ACHIEVE THEIR OPEN BANKING OBJECTIVES

Digital Wealth

Embracing the revolution

Over the last ten years we have seen everyday banking fundamentally transformed, with online and mobile channels becoming the norm. Now, banking is set to be radically disrupted again. Just as digital applications have displaced branch visits, in the near future customers may not even use a bank’s own digital applications for their banking needs. This is the Open Banking revolution.

The catalyst for change has been the enactment of new Open Banking regulation in the UK by the Competition and Markets Authority (CMA), and across Europe with the second Directive on Payment Services (PSD2). Both are driving a new wave of innovation. To comply with each piece of legislation, banks must allow trusted third parties access to customer account data and the ability to initiate payments. Application Programming Interfaces (APIs) are seen as the most effective mechanism for achieving this, allowing third-party providers access to the banks’ data infrastructures in a way that is both open and secure.

With this new ecosystem comes new opportunity – and new threats. Simply meeting the regulatory requirements isn’t enough. At Capco, we are shaping the future of banking by helping financial services institutions build digital business models, define their API strategies and bring new customer propositions to life using modern web architectures, best-in-class technologies and new ecosystems.

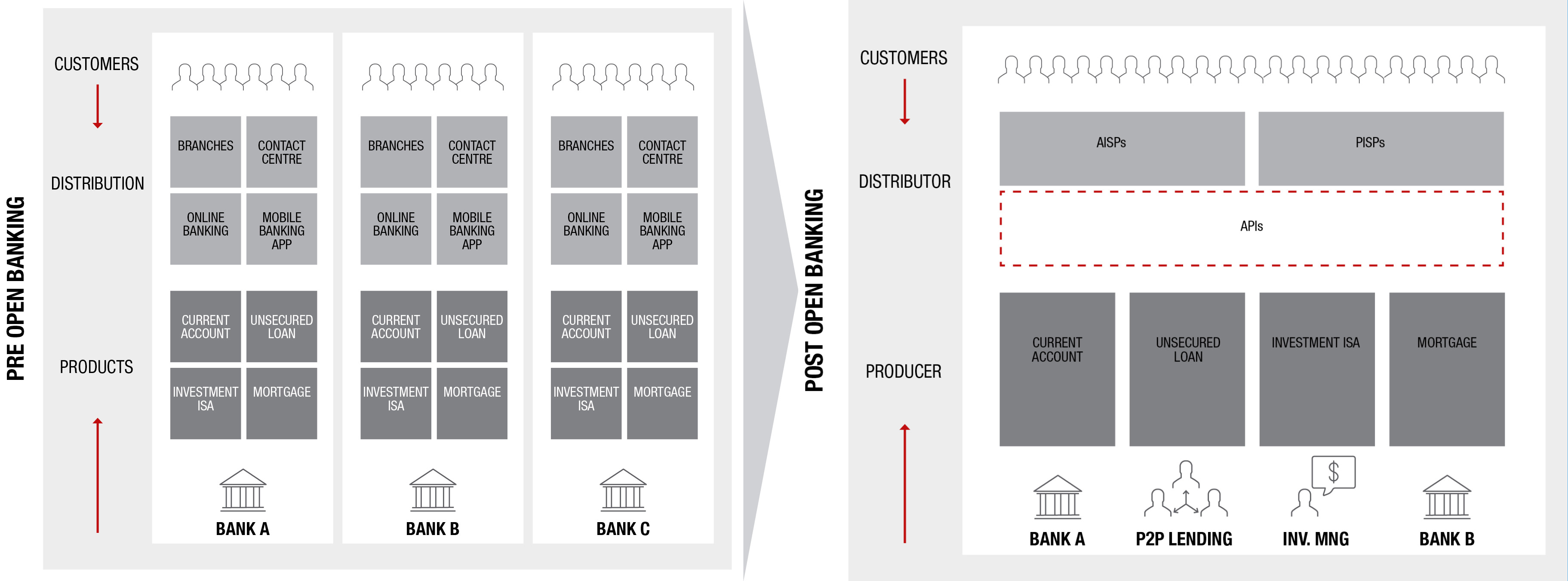

Vertically integrated banks

Most major banks today are vertically integrated, owning both production and distribution in a single value chain. Their products and services (current accounts, mortgages, etc.) operate within their own proprietary distribution channels (branches, online banking) and a tightly controlled, sector-run payments infrastructure (BACS, CHAPS, Faster Payments, etc). Open APIs will break incumbent banks’ monopolies on distributing only their own products to customers by allowing Trusted Third Parties (TTPs) to act as alternative distributors and offer products from a range of producers.

API Opportunity

APIs represent as great a threat and opportunity to banks today as the advent of the digital era once did, opening the market to greater competition around customer loyalty and engagement. Banks should not consider these APIs as simply technical interfaces that expose data to third parties but rather as radical enablers for creating new and attractive customer experiences. APIs are already commonplace across many industry sectors, where they are in fact viewed as customer products. Banks will have to follow suit if they want to remain competitive.

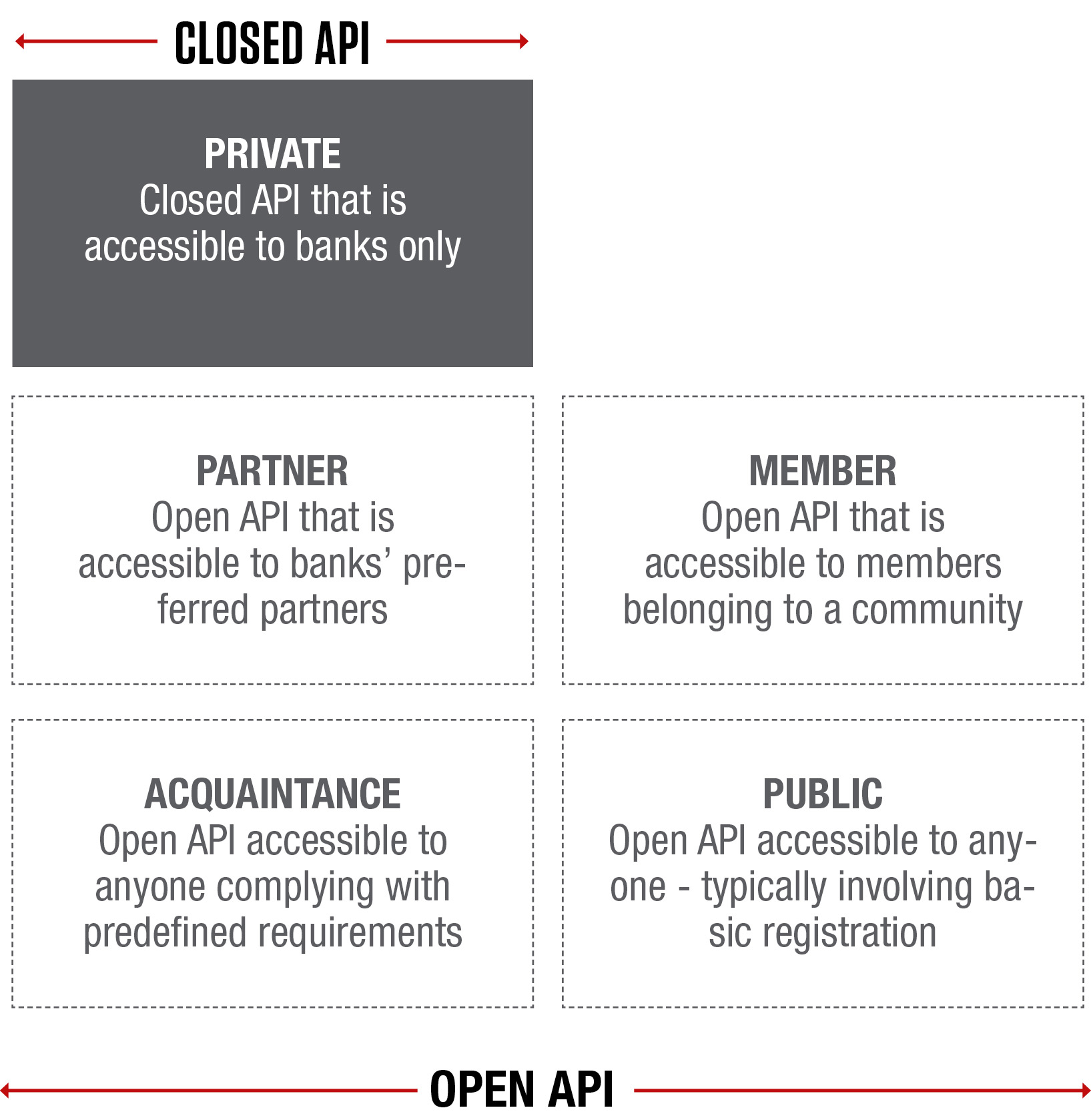

How open is your API?

APIs enable secure, controlled, and cost-effective access to data and/or functionality. It is relevant to stress that “open” does not mean that every third party can access a bank’s system at their discretion. There will always be some form of control by the bank, in order to preserve security, privacy, and contractual conditions. The level of openness determines the potential number of parties with access and thus the potential reach of the functionality offered through an API.

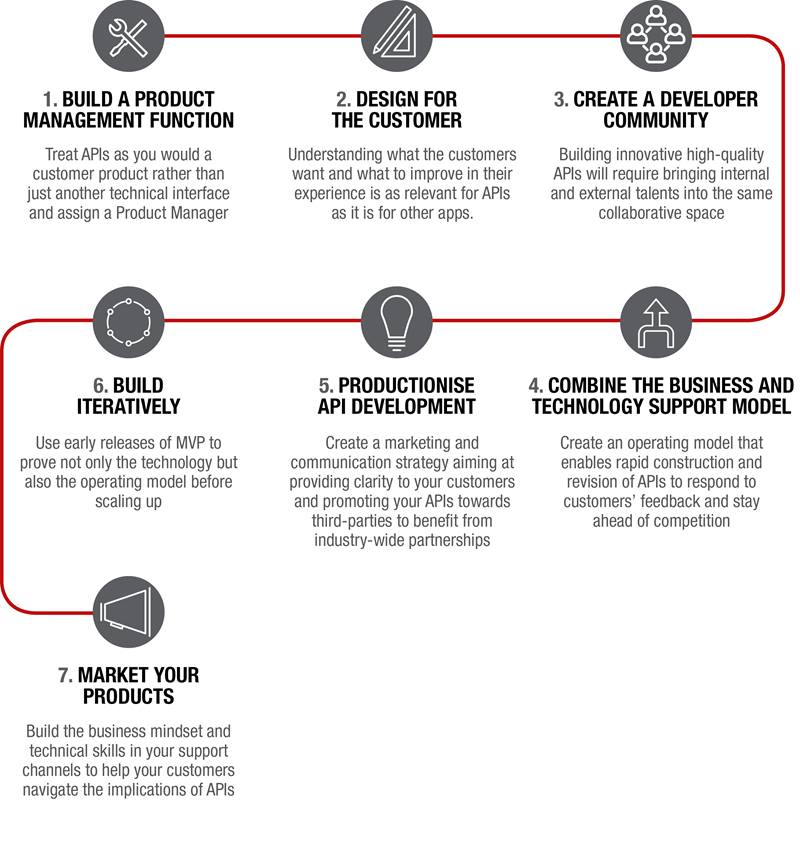

How to deliver API products

For banks looking to harness the full benefits of the APIs they create, experience from other industries shows that it is essential to treat them as customer products. Outlined below are Capco’s seven key principles to consider when building an API product strategy.

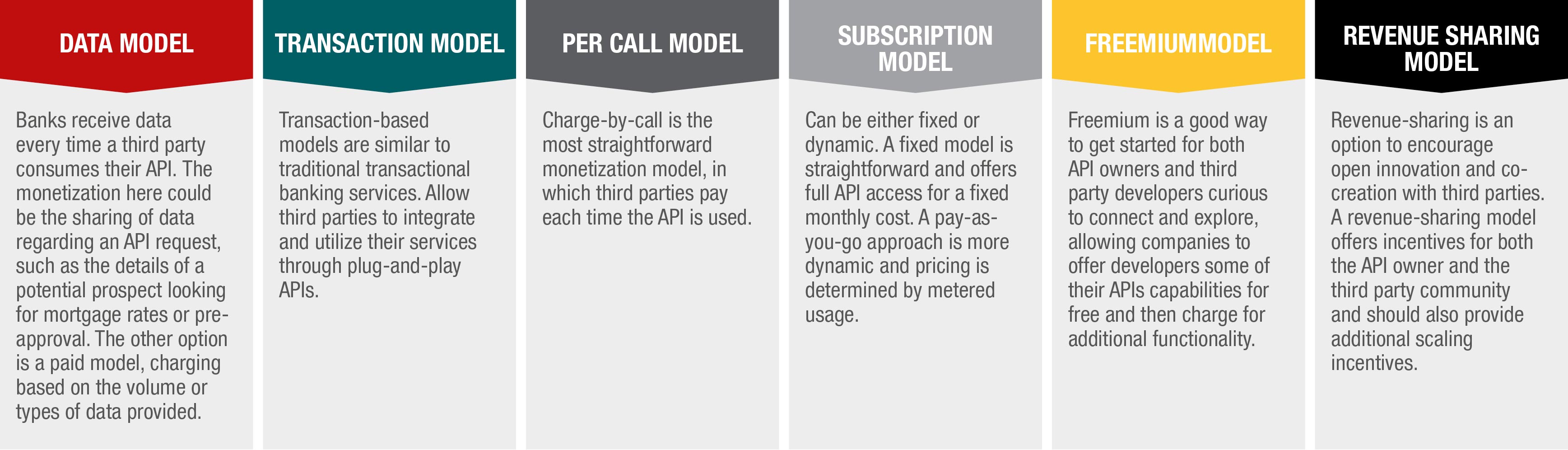

API Monetization

Once a bank begins demonstrating maturity on delivering their API product set, there are several methods for monetizing APIs that they should consider. Organizations will likely implement a variety of these methods based on the type of APIs and how they are offered.

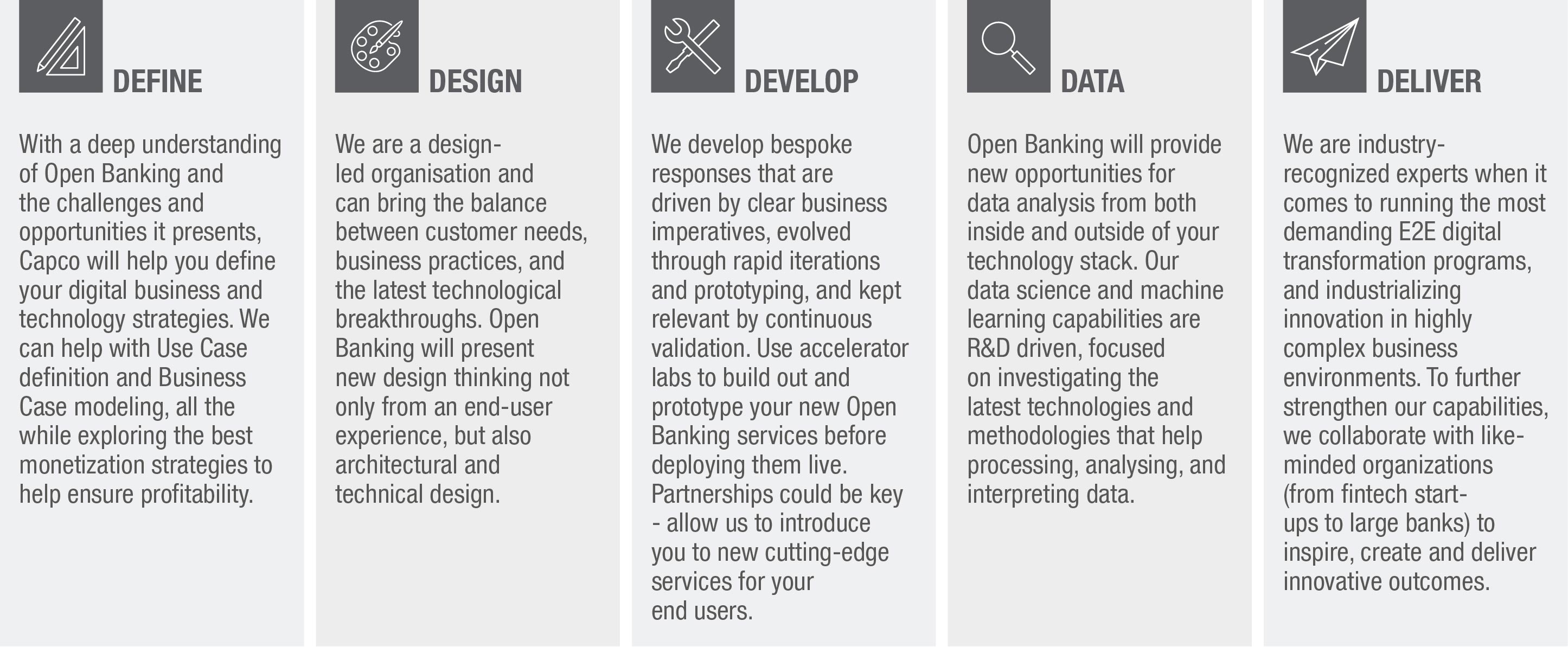

What can Capco offer?

Innovation begins with a vision but transforming a vision into reality requires more than imagination. As finance adapts to new technological possibilities and human needs, making these visions of the future come to life becomes imperative for success. We work with our clients to create unique solutions that will drive their business today and tomorrow.

Capco's experience

We have been working on Open Banking and PSD2 with our clients for a number of years already and have a proven track record of delivering against the regulatory requirements for them to meet their strategic ambitions.

We are thought leaders in the space, publishing articles and participating actively in the Open Banking Implementation Entity. Capco were also chosen to deliver the industry Open Banking sandbox to stimulate innovation before the official launch of Open Banking APIs.

Thought leadership

We actively engage with the broader banking and fintech ecosystem and have demonstrated our thought leadership on Open Banking through select publications, events and conferences. We have been featured in WIRED Magazine, the Sunday Times, and the Financial Times on Open Banking.

Strategy

We have worked with clients to help understand the threats and opportunities of Open Banking and PSD2 and then shape their strategic response. We always take a customer first approach to strategy work and have therefore undertaken customer research to understand customers’ attitudes to sharing their banking data using Open Banking APIs.

Product Development

As well as leading the delivery of Open Banking and PSD2 for Banks we have been working with banks and fintechs to create new propositions enabled by Open Banking. Using lean product and agile methodologies we have already designed and developed new customer products. We have launched customer pilots ahead of the Open Banking launch.

Sandbox

We were chosen to design and deliver the industry Open Banking sandbox to stimulate innovation before the official launch of Open Banking APIs. The sandbox is now live and being used by fintechs.

CONTACT US

NIC PARMAKSIZIAN

Head of Capco Digital

nic.parmaksizian@capco.com