On October 8, 2019, five federal agencies (i.e., the Fed, CFTC, SEC, FDIC, OCC and together, the ‘agencies’) adopted final regulations (the ‘Amended Final Regulations’) implementing the Volcker Rule and largely simplifying certain compliance requirements effective circa 2014. Generally, the Volcker rule prohibits banking entities from engaging in proprietary trading or investing in or sponsoring hedge funds or private equity funds. Volcker 2.0 is representative of a pendulum swing in financial regulatory compliance away from the strong reaction to the financial crisis of 2008.

Broadly, the ‘Amended Final Regulations’ focus on the compliance program requirements and proprietary trading components of the Volcker Rule; with minor changes to the covered fund provisions of the Volcker Rule . The ‘Amended Final Regulations’ constitute a loosening of the above-referenced requirements, particularly for banks with ‘Moderate’ and ‘Limited’ trading assets and liabilities (or ‘TAL’). However, banks with ‘Significant’ TAL (and ‘Moderate’ TAL banks, to a lesser extent) will need to re-assess their current Volcker Compliance Programs to ensure they remain compliant as well as to determine how to take advantage of the newly relaxed requirements. Banks affected by the Amended Final Regulations will need to take the following key actions summarized below:

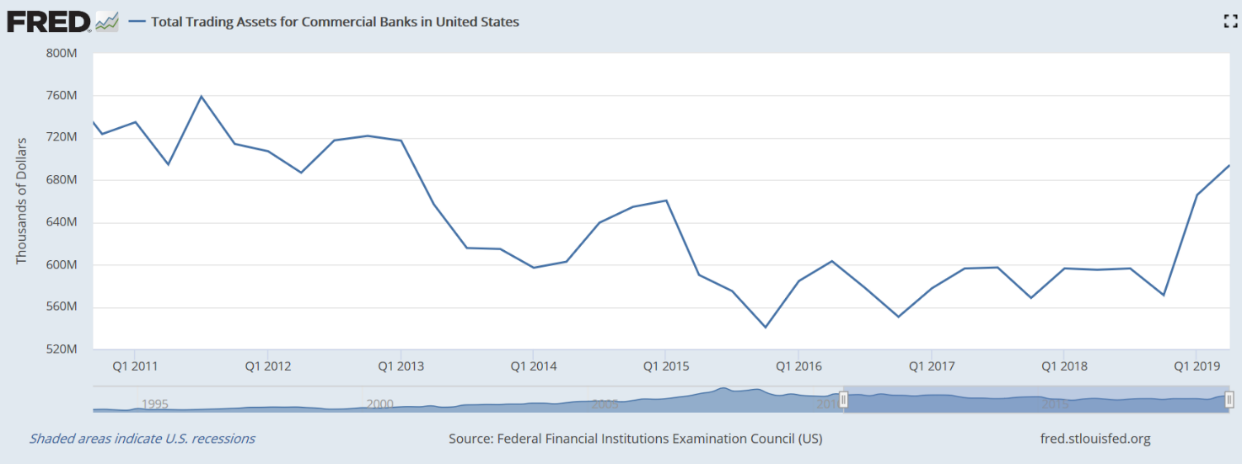

- Reassess Business Strategy: The amendments to the Volcker Rule include several opportunities to engage in previously unpermitted activities (e.g., FX swaps, FX forwards, physically settled cross-currency swaps and non-deliverable cross-currency swaps). These are now permitted under the liquidity management exclusion. Banks should assess their capital markets businesses to identify opportunities to leverage newly permitted activities and the reduced operational burden of Volcker 2.0. Different banks have commenced new strategies by increasing trading volumes and holdings. As an example, the table below illustrates a trend in the commercial bank sector, and how the trading assets volume is increasing in 2019 in anticipation of the Volcker amendments.

Figure 1. Total trading assets in the Commercial Banking sector

- Assess Volcker trading desk organization for potential realignment with existing regulatory reporting structures: By aligning the definition of a trading desk with other regulatory regimes (e.g., Basel), banks have the opportunity to manage their Volcker compliance programs more efficiently. The modification is intended to be straight forward as it allows banks to leverage existing regulatory reports (e.g., FR Y-9C and Call Report), compliance programs, and infrastructures.

This includes internal limits, risk management systems, and board-level governance protocols. Banks should assess their Volcker compliance program structures and determine the potential operational gains from reorganizing. Banks deciding to align Volcker with Basel will impact how their desk hierarchies/structures, how they allocate their balance sheets, and direct their business strategies..

- Adjust Volcker Metrics Reporting Process and Scope: The process and scope of reporting Volcker metrics change materially under Volcker 2.0. Banks will need to stop producing some of the original Volcker metrics, implement new metrics, schedule reports, and adjust the reporting cadence from monthly to quarterly. Overall, the banks will be reporting significantly fewer data to the agencies.

- Evaluate Internal Volcker Risk Limits and Control Frameworks: While the Volcker 2.0 amendments broadly loosen requirements across Subpart B and C, there is an increased expectation for bank’s with ‘Significant’ TAL to establish and document robust internal risk limits and controls to ensure that the bank’s trading activities stay within the parameters of the rule. Banks should undergo a thorough assessment of their risk limits and controls to maintain compliance and minimize regulatory scrutiny.

- Update Relevant Volcker Compliance Documentation: Compliance documentation including but not limited to: policies, procedures, process documentation, trading desk mandates, liquidity management plans, committee charters, control documentation, risk limit definitions, and model documentation will need to be reviewed and revised to align with the rule amendments.

Streamline to WIN

In summary, Volcker 2.0 allows for a significant opportunity for banks to realize operational efficiencies within their capital markets business and expands their permitted trading activities. Nonetheless, there is an increased reliance on internal controls and limits. Partnering with a trusted advisor is crucial to navigating this new regulatory change. Banks can realize these operational efficiencies by aligning compliance programs and processes across Volcker and other regulations.

Further, the newly permitted trading activities allow banks to engage in previously restricted products and will result in increased liquidity in the market.

This blog post is meant to represent Capco’s high-level interpretation of the recently approved final regulations of the Volcker Rule. For specific details on the amendments, refer to the Volcker 2.0 Field Memo.